omaha nebraska sales tax rate 2021

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. The current total local sales tax rate in Omaha NE is 7000.

How High Are Cell Phone Taxes In Your State Tax Foundation

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

. Groceries are exempt from the Nebraska sales tax. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The omaha sales tax rate is.

Sales Tax Rate Finder. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. Beginning January 1 2021 the local sales tax rates for Gordon Greeley and Juniata will each increase from 1 to 15 which brings the total to 127 cities in Nebraska.

Businesses that make taxable purchases for resale manufacture or processing must pay a use tax instead of sales tax. The December 2020 total local sales tax rate was also 7000. 8 is the highest possible tax.

Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. The Nebraska state sales and use tax rate is 55 055. Integrate Vertex seamlessly to the systems you already use.

This is the total of state county and city sales tax rates. There are no changes to local sales and use tax rates that are effective october 1 2021. As we all know.

Sales and Use Tax. Request a Business Tax Payment Plan. Rates include state county and city taxes.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2021 sales tax rate for omaha nebraska is. If the tax district is not in a city or village 40 is allocated to the county and.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Free Unlimited Searches Try Now. Make a Payment Only.

See the County Sales and Use Tax Rates section at the. Changes in Local Sales and Use Tax Rates Effective January 1 2021. Ad Get Nebraska Tax Rate By Zip.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The omaha sales tax is collected by the merchant on all qualifying sales made within omaha.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. State Tax Rates. The current sales tax rate in Nebraska is 55.

See the County Sales and Use Tax Rates section at the. What is the sales tax rate in Omaha Nebraska. That means that in a city that imposes.

The base state sales tax rate in Nebraska is 55. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The latest sales tax rates for cities in Nebraska NE state.

The local sales tax rate in Omaha Nebraska is 7 as of September 2022. Easily manage tax compliance for the most complex states product types and scenarios. Current local sales and use tax rates and.

Counties and cities can charge an. Ad Accurately file and remit the sales tax you collect in all jurisdictions. 2022 Nebraska Sales Tax Table.

Average Sales Tax With Local. Find your Nebraska combined state.

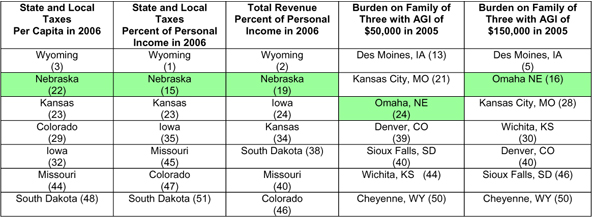

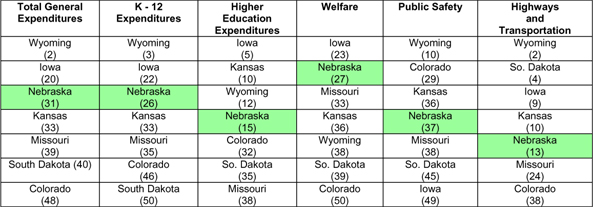

Compared To Rivals Nebraska Takes More From Taxpayers

Nebraska Sales Use Tax Guide Avalara

Sales Taxes In The United States Wikiwand

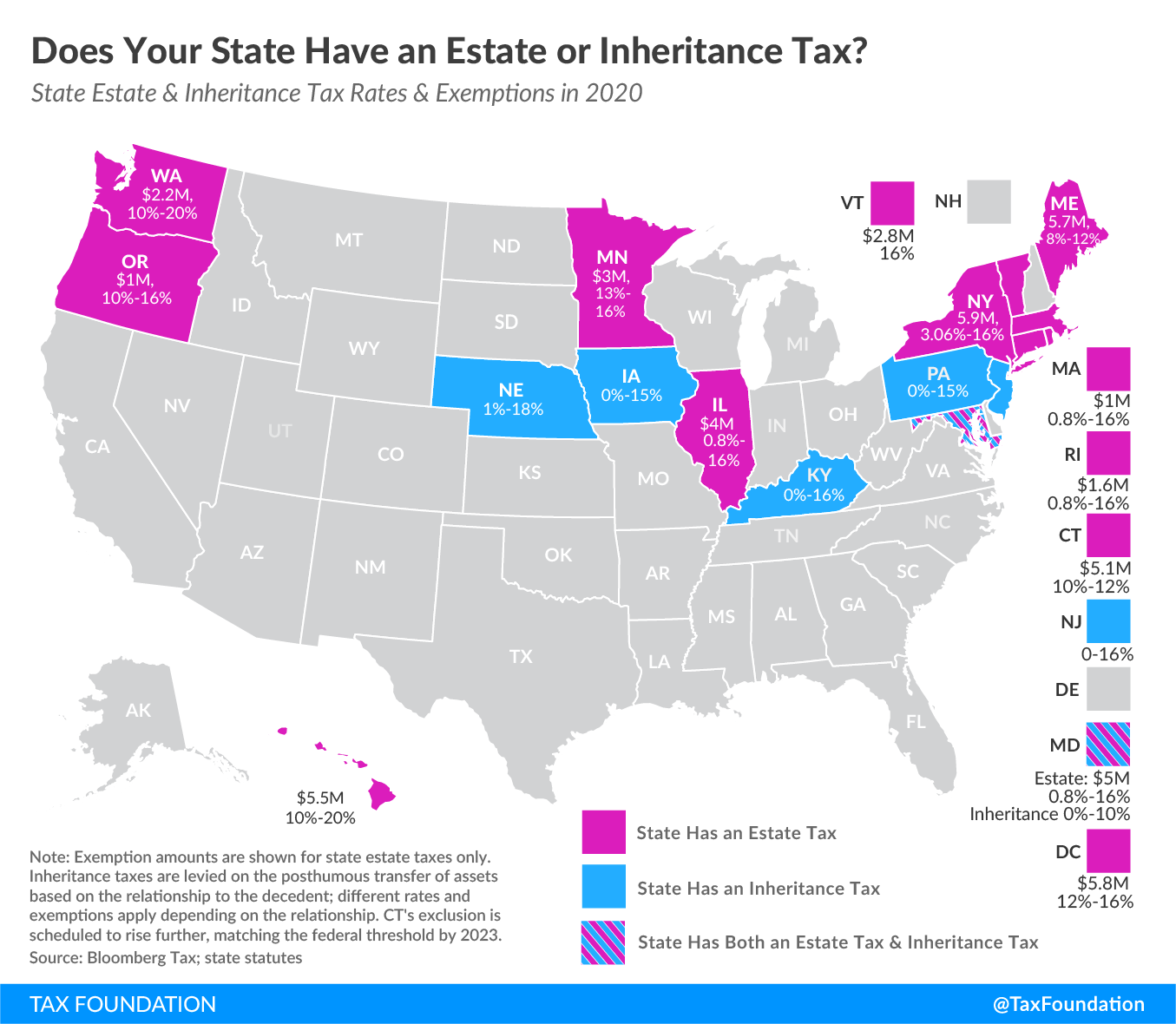

Don T Die In Nebraska How The County Inheritance Tax Works

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

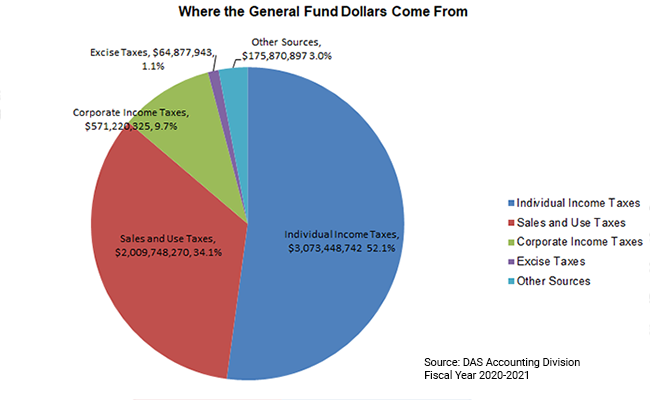

General Fund Receipts Nebraska Department Of Revenue

New Ag Census Shows Disparities In Property Taxes By State

Get The Facts About Nebraska S High Tax Burden

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Cell Phone Tax Wireless Taxes Fees Tax Foundation

What Is A Homestead Exemption And How Does It Work Lendingtree

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand